New World Wines for a New Generation of Wine Investors

Matthew Small, Portfolio Manager

Matthew Small, Portfolio Manager

Talk about investing with anyone and nine times out of ten the name Warren Buffet comes up. Warren and his mentor Benjamin Graham developed a style of investing that focused on the fundamentals of a company, creating an intrinsic value based on these fundamentals and comparing it to the market value.

We’ve taken a bit of time out to see if we can use this “Value Investing” strategy in the fine wine market?

Firstly, let’s look at what all top investable wines have in common.

- They have a great critic score like the 100-point 1989 Haut Brion

- Low annual production like the DRC Romanée-Conti at 500 cases per year.

- Come from a big-name vineyard with heritage and a story such as Chateau Lafite Rothschild

Based on the above fundamentals, is there a winery or region that meets all the criteria at a fraction of the price of its Franco friends?!

“Hell Yeah!!” Napa Valley Baby!!

Napa burst onto the scene at the infamous 1976 Judgement of Paris, where 11 unsuspecting wine judges, unanimously picked the Napa rouge in a blind taste test over the old-guard Bordeaux. Since then Napa has been racking up 100-point scores from all the major critics, smashing our first fundamental.

Scarcity is key to the value of a wine, like any luxury good the limited supply drives the price.

Next, let’s look at production. Scarcity is key to the value of a wine, like any luxury good the limited supply drives the price. A first growth Bordeaux such as Chateau Lafite Rothschild can produce circa 35,000 cases per year compared to the top-rated Napa, Screaming Eagle which limits production to circa 1000 cases. When these wines reach their peak drinking maturity with the majority of the vintage consumed, scarcity drives price.

Finally are there any Napa wineries with a story or heritage? Napa Valley is based on stories. Take Robert Mondavi whose feud with his brother led him to leave the family winery and relocate to California with the aim of creating Cabernet better than the French. Or what about Brett Lopez who bought JJ Cohen’s land and named his wine, Scarecrow after JJ’s most famous film, The Wizard of Oz.

So the big question… Why is Napa trading at such a discount?

It was America’s worst kept secret. The domestic demand for Napa wines was so strong that US suppliers were not incentivised to export to more complicated international markets. A point highlighted below by Lisa Perrotti-Brown (MW) in a recent Cult and Boutique podcast.

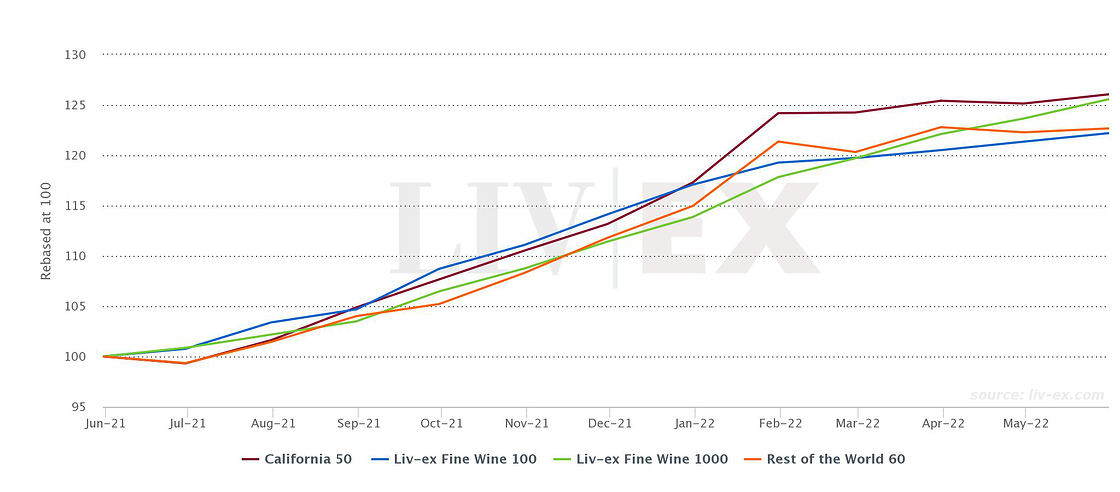

The data also backs up this increased adoption of Napa wines. Between January and June 2022, 154 different Californian wines have been traded on the Liv-Ex exchange vs 145 wines in the same period of 2021. The California 50 (the Napa index) performance also strengthens this argument up 26.1% over the last 12 months vs the benchmark Liv-Ex 100 up 22%.

Don’t be fooled into thinking nine extra wines traded is insignificant. A 6% growth rate is a characteristic of the early adoption phase in the growth cycle. The early adoption phase is a great entry point for investors before the growth curve accelerates into the early majority phase.

We can see that the Napa Revolution is on, and now the French are getting in on the action. LVMH just announced the acquisition of Napa Stalwart, Joseph Phelps Vineyards. This deal adds to the LVMH roster of international wine market titans including Dom Perignon, Moet and Cloudy Bay.

It’s clear LVMH believe Napa wines are going to be the next global trend with the CEO citing increased demand in Europe and Joseph Phelps’ iconic name and heritage driving the purchase!

Please note that LVMH is buying Joseph Phelps at the top of the Californian real estate market. Details of the deal have not been released however values of circa $725m have been rumoured which is more than double paid for any other Napa winery in recent years.

It should also be taken into consideration that interest rates are expected to rise considerably in the coming quarters making any debt used for the purchase much more expensive. Despite the high price tag and economic concerns, LVMH is confident in Napa’s global potential.

Millennials are looking for quality wine investments which don’t necessarily adhere to the status-quo.

Leading the adoption of Napa Reds are the Millennial / Gen Z demographic. A study performed by market research agency 3Gem showed that 75% of the under 25s who invest in wine spend up to £20k a year on the liquid asset. This trend is expected to expediate as an estimated $68 trillion dollars will be inherited over the next 20 years.

Millennials are looking for quality wine investments which don’t necessarily adhere to the status quo. Winemakers who make exceptional quality wines, with interesting bottle designs and modern art labels are much more appealing than family crests and an antiquated En-Premier system.

Given the current economic climate of high inflation, rising interest rates and low economic growth many investors are looking at wine investment as a counter-cyclical hedge. Given the large growth opportunities in the Napa region, the Californian stalwart is my number one growth trade for any wine investor’s portfolio.

Very rarely do LVMH, Lisa Perotti Brown and Warren Buffet’s investment style align, but when they do, it’s time to Buy!