Winemaker John Worontschak visits The Cult & Boutique Show to talk about Litmus Wines, Ginking and his global adventures in winemaking. Having worked in just about every winemaking region you could think of over the years, John had some great experiences to share with us.

Full auto-transcript

Cult & Boutique Wine Management (00:00):

Hi, welcome to another episode of the Cult & Boutique Show, it has been a while, but, um, you know, good things come to those who wait. And fortunately, today we have with us a very influential guest within the wine, uh, world not just in England in and Europe, but internationally as you will find out, um, he just joined us this morning. Um, he’s in the middle of crushing his grapes from his English vineyard Denbies. Um, if I could present this time, none other than Mr. John Worontschak, John. Good morning. How are you?

John Worontschak

Hi, well, thanks.

Cult & Boutique Wine Management

Good. Good. So obviously with regards to yourself, you were born and raised in Australia and you started your wine experiences in Australia. Could you tell us a bit more about that?

John Worontschak (00:43):

Uh, yeah. Well, I was born in Adelaide to a Ukrainian parents. They, uh, came out after world war II, fortunately, and, um, I had a pretty normal Australian upbringing you’re surfing and scuba diving and all that sort of thing. And, uh, when I was at university, went to university of Adelaide to do geology and, um, fortunately there was a little place called Petaluma up the road. Um, and I got a weekend and holiday job there, um, which was probably the first of a series of very fortuitous events because, you know, the two guys there, Brian Crozer and Dr. Tony Jordan sort of icons, you know, revolutionized the Australian wine industry and really said, I think, you know, the world on fire.

Cult & Boutique Wine Management (01:25):

Okay. And, um, through what era was, I believe I was, it was seventies, eighties around that time.

John Worontschak (01:31):

Well, my first job was at Petaluma. I was hand labelling bottles for the 1976 Chardonnay, Petaluma Chardonnay. Um, and so I was there for the 1977 vintage, which I believe was the first or the second vintage that, uh, Brian Crozer had done there with the Petaluma label.

Cult & Boutique Wine Management (01:50):

Wow. Okay. And obviously with, with, regardless of the culture of the seventies and eighties, uh, in wine and in specifically Australia, what was it like say compared to the rest of the world at that time?

John Worontschak (02:02):

Yeah, at that stage, I didn’t really know a lot about the rest of the world, but, um, uh, the Australian wine industry was, uh, was in tumultuous change at the time. Um, most of the wine makers were, um, family, um, untrained know scientifically, um, and then to start working at Petaluma with Crozer and Jordan who they set up the Walker school of theology. And at that stage, it was only two places you could go. Um, Waga, which was a degree course in Roseworthy, which wasn’t a degree course. And then I thought, because working at pedal Limerick, all wineries were like that. And looking back on it, it was so incredibly prestigious when you could, you could eat off the floor. It was, it was, he spent all of your time cleaning and using things like a sloped yeast, because there was no bike biotech in those days, there was no dry yeast or something.

John Worontschak (02:53):

So there was sleep sleeping. Their own yeast strains are two was the big one in those days. Um, and they doing crazy things like fermenting re you know, keeping reasoning cold until the winter and fermenting in the winter, very clean juice. They had all these axioms, which produced the best wine in the world, as I thought at the time. Um, uh, some of which now seem pretty outdated and pretty simple, but just love, very clean juice protecting from oxygen and very cool. Fermentations um, and then just being, as I say, fastidious in every single aspect of the winemaking process from a scientific

Cult & Boutique Wine Management (03:29):

Basis. Yes. Alright. Very interesting there. And, uh, obviously from Navy decided to go traveling, uh, I believe you’ve traveled for around six years doing ventures in California, France and Australia. When did I begin was on the 18th,

John Worontschak (03:44):

I ended up going to Wagga and because Crozer sort of suggested it. Um, and so I spent there until getting the wine making degree, um, until 84 and I did a vintage, I did about 18 months, two years at Campbell’s winery again. I mean, at the time you can imagine it was in rather Glen and working port and Tokay and musket. And again, surrounded by icons. We used to go to a place called mrs. Hoppies, um, every second Tuesday in coral. And there’d be, um, yeah, that’d be bill chambers, McMorris legends. We’d have like fishing trips for starters and steak and chips.

John Worontschak (04:24):

Maybe there’s sort of a 90 year old musket. Why? Well finish off the evening. It was Halloween days. And so I did that and then a few sort of vintage jobs that you lumber and Penfolds, what have you. And then I decided to start traveling. It was 85 months, first vintage in California at clouded war. Again, I didn’t realize it was an iconic kind of winery. Um, but with John Holly was a winemaker there. Um, and you know, that stage, it wasn’t hugely different from the Australian industry, um, much less studious, um, than, than Crozer the Crozer was in, in, in terms of monitoring everything, but still making some pretty good wines for the time. Now though, would have been, that’d be considered over Oaked and in those days it was pretty exciting.

Cult & Boutique Wine Management (05:11):

Um, well, when you was going between or from California to France Australia, was there any significant differences that you notice in terms of their approach to wine or their wine making skills or their attitude or philosophy, how specific wines or wines in general should be made and who should consume them, et cetera? I guess the first real taste.

John Worontschak (05:32):

So I had a very different culture was the 85 winter harvest, or the sorry, the 85 Northern hemisphere harvest in, um, a Hugh girls in Alsace. Okay. Again, Johnny Hugo, another icon, I seem to have landed and all these places where there was a where there was some, some pretty interesting characters. Um, and so, uh, I did two vintages that the Hugo’s working with Mark Hugo, interestingly, he had just done an unfinished of indigenous Australia and he came over and changed all the wine, making a few girls. Similarly, he fell in love with a process of very cold, clean fermentations and aromatic yeast strains. And what have you, which nobody liked. So he, so he went back to back to the old, old ways and eventually, which seemed to make more wines with more sort of velocity and more character. But yeah, doing this, those two harvests that a few girls gave me a taste of sort of, sort of European ideas and starting, just starting on the road to thinking, well, maybe just maybe we don’t know everything.

John Worontschak (06:34):

Uh, you know, when I, you know, when I left, I thought, well, that was it. I sort of knew it. No one in the old world had a clue what was going on. So wines were funky and strange. So having, but then tasting some of the you, so the older Hugo ones with Mark you go, yes, I think, well, actually there’s some characters here that are really interesting. I sort of, you know, and then having some nice Vonage tardy from, from years gone by was also pretty, pretty special, good experience plus, and so I guess then from there I traveled, I did six or six years, I think I’m just doing hemisphere hopping and traveling with traveling around the place. After, after close by in California, I came to UK just as Australians do. Um, I met my current wife and then we saw we started traveling.

John Worontschak (07:22):

So we did six years. I worked at Penfolds for three years in Australia and gender and Loxton and the Prosser again, picking up invaluable experience in doing the Northern hemisphere and in between we’d stop in India or China or Eastern Europe or somewhere to have a bit of a holiday. Um, and then in 1998, I came across a chat by the name of John Layton who had an English vineyard called the Thames Valley vineyard. And that was in Russia. And so I was working in London, temping, and indeed with him. Okay. Okay. Which of my first taste of English one. Wow. I, wasn’t very nice.

Cult & Boutique Wine Management (08:03):

I can imagine. Cause today, obviously, you know, with your wines in particular, you can tell the very refined and, you know, up to where they need to be in terms of quality, you know, for sure. And compared to what it would have been in the early nineties. Whoa, what, what would the English wine tastes like back in the early nineties?

John Worontschak (08:21):

Well, there’s the old adage, of course. How many men does it take to drink a bottle of English wine, three to hold him down? Um, so, uh, they were the ones who were awful. They were, um, generally very green. Um, and, and, and, and, and bitter, um, that was sweetened often oxidized. They were sweetened up with a Swiss reserve and put in a hot bottles with dramatic labels. Uh, and generally, you know, when I first got here, I bought a whole bunch of them and, uh, to try to find out what, what the story was and couldn’t get anything out of it though. So I went to New York state to have a look cause they were, they were a bit hit, but I mean, for sure to see again, the serendipity, I, um, you know, I managed to get, uh, into the English wine industry, um, at, at, at a stage where there’s not a lot of competition in terms of quality.

John Worontschak (09:09):

Uh, and I introduced my quite simple and basic Australian wine making techniques and which has been clean called fermentation, as I said before. And, um, and just started winning everything, gold Brown trophy look five, six years in a row. And, you know, uh, it was really exciting times. And that was when, uh, I guess, you know, I got a lot of publicity, you know, international as well. It hadn’t been frustrated and film crews coming out and saying, what’s going on in England. I mean, every few years in England, there’s a re you know, there’s the emergence of English wine. That was probably a second or third time. It was, you know, it, it has emerged. Um, and, uh, so that was pretty exciting times and really interesting. I set up a, a small company called, um, harvest wine group, uh, and, uh, consulted for 13 vineyards and, and, and, and, and contract wine made at the Thames Valley vineyard.

John Worontschak (09:59):

Um, and then set up a little company called harvest one group, which was a, which was a marketing concern. So we actually got these 13 vineyards wines into a lot of shops, like threshers and a lot of places that don’t exist anymore. Um, uh, and we, and we did well there, but, um, what the problem turned out to be was they just sat on the shelf and we had no ability or capability of helping them get consumed by the consumer. So although it was positive in terms of getting distribution and we didn’t actually sell very much wine to people. Okay. Okay. You mentioned obviously, and you’ve touched upon the, um, coming over to the UK and that’s the way you met your wife and eventually you assessed down in the UK, uh, around [inaudible] we set up the harvest, uh, wine consultancy or UK wine consultancy at Sam’s Valley vineyards.

John Worontschak (10:53):

You know, how that opportunity to come across. Uh, how did you find Julia is there to benefit you? So, um, because of the publicity and the quality of the wines we were producing for, for Thames Valley vineyard and for, um, you know, for our, for our contract clients, um, I got, uh, some, some notoriety and then started tasting for wine magazine and getting a bit more involved in the London scene. So again, very fortunately I ended up in London, which is, you know, a place where you can really learn about wine. It was, uh, it was very eye opening at the time. Um, and so I was there for 10 years or so, but, um, in 1993 was the first of my, um, flying wine making experiences. And so I went to the Czech Republic, um, um, to make some Bryn of Atlanta and some Blaufrankisch for Tescos. And in those days they put winemaker’s name on the label. Okay. Um, so that was the first one. So that was in October 93. Um, and I’ve been pretty much traveling nonstop since then, um, and a lot for Tesco’s in the early days. Um, and then through contacts that started consulting to wineries around the world in terms of production. Uh, and I’ve been doing that ever since until a lockdown.

Cult & Boutique Wine Management (12:16):

And you made a couple of interesting,

John Worontschak (12:17):

The point is though, in terms of how you’ve been traveling around the world, um, and you’re in some very historic, traditional Y making countries such as, uh, Moldova, and there’s some very unique why making countries such as, uh, Mexico, Israel, so on and so forth. How did those opportunities come about? Was that something that you saw as a challenge, like he may have done with, you know, producing your English wines back in the nineties, or was that something you as approach to the bow and you fought, I like a challenge. I could put these wines on the map. Let me show you what I’m capable of. Yeah, I, to be fair, I have been involved in pretty much most regions in Italy and France and Germany as well. I’m a bit in Spain. Um, but, uh, I think for whatever reason, I’ve become sort of poster boy for, uh, strange places, which again, it’s worked to my favor in many ways because, uh, for instance, uh, I went to South Africa in 94 just after Mandela, um, won the presidency.

John Worontschak (13:28):

And that was really interesting. Again, going, you know, learning about cultures of place. I really love South Africa. It’s a beautiful country. Um, but at the time, because of apartheid, they just were comparing themselves amongst themselves. They had no international perspective. Um, and so again, you could go into a country and make big changes. And so, you know, wines were tasted totally for it in those days. They were somehow fixated on, um, sort of very bitter extracted peanut Taj that you had to put in the fridge to, to drink a cold and to watch that, um, I’ve been going to South Africa ever since, and just recently stopped and, um, to watch the evolution to where they are now, which is, you know, they know exactly what they’re doing for the forefront of, uh, interesting wine styles and definitely know that they are the young wine makers and they’re just the zoo crew and doing fantastic things. Yes, that was good. And then, so Russia as well, I got, I went to Russia in 2002 for the first time still working out there in 2000. You couldn’t imagine.

Cult & Boutique Wine Management (14:33):

No, that’s fine. Yeah. Yeah.

John Worontschak (14:35):

I mean, they’re just undrinkable. I mean, to the point where, you know, the first thing I did was to measure the dissolved oxygen levels in the wine. I know like nine milligrams, eight and nine milligrams per liter, which I didn’t know was possible. That’s super saturated, right? So all the winemakers used to drink wines out of tank cause they still weren’t too bad once in bottle, that’d be totally knackered. And the whole concept of tasting, I mean, no one spent any wine out and I was always sort of salami and cheese during wine tastings. And, um, and then just their, their ability to talk nonsense was sort of this wine has got flowers and petals of you and it’s just naked undrinkable. Um, and again, so to, to go in there and then I started working at a place called ms. Kako in novel risk.

John Worontschak (15:17):

Um, uh, and we just, again, like in England, which are making wind, Aaron’s going, what’s going on there, this tastes normal. So this tastes okay. Currently I’m working in a place called fan of [inaudible], which is a 30,000 ton winery. And the owner, one of the owners, Peter, a musician, he I’m very dedicated to quality and we’re making some really good wines, not just okay wines, but really good wines and, you know, beating a lot of these little boutiques owned by the oligarchs, all the friends of food and, you know, in open competition within a 30,000 ton winery with like sort of three or 4,000 barrels, um, you know, that’s been good. And it’s also the beauty about working in, in, um, in Russia is that because I could speak Ukrainian, it wasn’t very difficult to actually master the lingo, which is, um,

Cult & Boutique Wine Management (16:05):

It was massively, especially in Russia. So they respect that. So such high standard, if you can speak, like you said, the lingo of a wise, it can be a bit hostile trying to try to do business, but I’m kind of sidetracking next. You make an interesting point. When would the people you work with over in Russia? Obviously a lot of these French vineyards, as an example, we’ve seen the wave of Southeast Asian, um, investors, you know, business magnates take over and once, uh, you know, make a lot of French wine. Cause of course back in Southeast Asia wine is extremely popular with, um, the people you work with and the other people in Russia that your competition is that are these boutique Kodiaks, et cetera, is the key working with people who are rushing because they might understand not the Vita culture and how to temperatures may help produce us in quantities of grapes, or is it best to call say the so called experts and who may not have experienced such climates as Russia, but know how to work in? Yeah, it’s a good question. I [inaudible]

John Worontschak (17:12):

Usually in the first couple of years, because, you know, in those days I was doing maybe 12 vintages at a time sort of thing. I would, um, I would get young winemakers either from Australia or from New Zealand or from somewhere trained. And they would actually be there for the harvest and be my ears and eyes. And, and because you have to break a few, uh, you have to break a few eggs eggs to, to, to, to, to get this to work. Um, and, and, and also break down the old culture of the way they do things and that if you’re not there, they just slip back into it. And the best way to be able to achieve what you wanna achieve is to have a owner who employs everybody there, their tobacco 100, and then they will do what you say. But if you don’t have that backing, then it becomes much more difficult and it’s better to have somebody there for your eyes and ears during the harvest.

John Worontschak (17:59):

But having said that, you know, that changes after a few years. Cause you know, they see the difference in quality. They, they, they, they feel that, and then they become engaged in improving themselves. And, and, and so the winemakers now in Russia, they’re all rational ones, Moldovan, but it’s a similar sort of concepts. There was about 10 years ahead of Russia, 10, 15 years ahead of Russia in terms of modernization of the wine industry. Cause they, they, they started in the nineties, I think the early nineties, I think Penfolds went out to Moldova and did joint ventures with Hugh Ryman and all those sort of people. So they already had, had, had moved on. Um, so yeah,

Cult & Boutique Wine Management (18:39):

Way, the way, the way it works, really brilliant. Alright. And something that might be a, an interesting concept that people may not want viewers and listeners and clients might not be familiar with is the flying wine-making, which you were parts of for almost a decade. You know, when people hear flying, winemaking, they’re thinking what exactly is flying winemaking but when you look into it is it’s a very good initiative that has a lot of benefits. So what, what would you, how would you be able to best describe flying wine-making and could you give a say, uh, what a typical season was for yourself being a flying winemaker?

John Worontschak (19:15):

Um, there’s two rural definitions of it. I suppose there’s a flying winemaker who’s who goes and does vintages, which is what I was doing for those six years. And you go there and you work and hopefully you can, you know, you can change a few things and put out a few ideas, you know, depending on what the chief winemaker you’re working for is, and that’s a lot of flying wine making, but I’ve sort of moved on from that and became more of a, it became more of a consultancy because I’d fly in and taste, everything, have a conversation. And also you start looking at the management structure of these companies and whether, you know, you know, maybe the winemaker would be a better one room manager and then they’d, his assistant would be a better wine. And, you know, you can shuffle people around or if you have, or instigate different techniques, we have a chief red, chief white, you know, things that they didn’t think of doing before.

John Worontschak (20:02):

So you be, it becomes more of a global picture. For instance, I’ve been working in Mexico for 25 years and it is rough for 25 years in the same company. And so, frankly, there’s not a lot more apart from having an outside overview coming in from the outside. And the beauty about doing that in so many wineries from Canada to China and everywhere in between. Is that something that they don’t possibly realize and you would keep it just between you and me is that you actually learn more from these people than they do from you because you know, everyone’s doing something different. The soils are different, the grapes are different, the processes of the equipment are different. And then you just, you see something and you go, wow, that works here, might over there, or that really doesn’t work here. And that, so you actually learning all the time, um, uh, not only about wine making, but also just cultures, just, just the different country countries. I mean, Brazil, I worked in Brazil for four or five years. That was just fantastic. I mean, it’s sort of like this indigenous population mixed with sort of Italians and Germans and, you know, the whole thing is just fascinating. And then the ridiculous climate there, and there’s sort of blue vineyards from the copper sprays and, um, yeah, it, everywhere has got, got stories for sure. Alright. I should’ve been jotting them down and

Cult & Boutique Wine Management (21:24):

Yeah. Written the book, your own memoirs. You never know. It could be a thing, could be a thing. Right.

John Worontschak (21:30):

Gotten my percent of everything over.

Cult & Boutique Wine Management (21:32):

All right. I’m moving on to four corners consultancy, which was an international consultancy sauce. And at the turn of the millennium, what, what was the approach there? What was the initiative

John Worontschak (21:44):

Harvest wine group that all started really included? Why? Because at the end of the season, I said to the winemaker, you’ve got serious health, health, and safety issues here. I mean, catwalks and plugs and stuff like that, you know, you should really look at it. It wasn’t a cop, it was a cloud of while before it moved, it was in Hillsburg. And he said, okay, well do me a report. I said, well, okay, but I’m gonna have to charge you for it. He said, okay, how much you want? I said, $200. I said, okay, thought that was a week’s work. So I was getting $5 an hour. And so that’s 40 hours work and it took me a few hours. It wasn’t handwritten because there was no computers or any way to type it. Um, and, uh, so I sent him an invoice, which I’ve still got the carbon copy of for $200.

John Worontschak (22:23):

He paid and I thought, well, this is probably better than working with your hands if you work with your mind. And so that started. And so then when I got to the UK, um, I didn’t work for Tim’s Valley vineyard. I consulted for them on a consulting basis. So they decided I’d invoice them and they’d pay me. And I set up the contract winemaking service where I, where I would bill the clients and then pay for the use of equipment, which is basically what I still do today at Debbie’s yards with litmus wines. Um, and so four corners consultancy, uh, progressed from that because it became a more of an international thing. I was now working in South Africa and Canada and France and Germany and all over the place. And so I changed the company, made it a limited company, um, and, uh, changed the name to four corners. And then at one stage had even a four corners range of wines, which, um, which was selling in the UK for a bit, which was a bit ahead of its time. Really. So had my wine-making in different countries, we did Uruguay, we did Bordeaux. We did, um, a few other places, Romania, one other place. And they all had the same sort of four corners label on them. Oh, wow.

Cult & Boutique Wine Management (23:30):

How would you think you may revisit that again maybe, or

John Worontschak (23:35):

What I didn’t do. I think I’m doing that. You take away any provenance. And, and I think in retrospect, if I did the marketing research beforehand, they probably would have realized that the general public don’t want some brash Australian kid riding around city in France, what to do. Uh, and so even though I’ve got it on the shelves again in Tescos, it wasn’t a great success commercially it’s fun to do, and it didn’t cost me, but it wasn’t, uh, the best thing in the world, but there’s other brands that are doing it now. Of course. So you never know, you never know. Okay. So obviously with regards to you reference of course, litmus wise limited and, um, warrant stack, wind substance limit said, which should be gotten from 2008 and there’s still a presence that a stay. So it was what are the operations there?

John Worontschak (24:32):

Well, in 2008, I, um, I got together with, uh, Sam Harrop and he had a consultancy business and I had a consultancy business and we, we joined our forces. Uh, it was, uh, uh, in a bid to help the wineries we consulted for reach the market. Um, and so it’s a pride and overall service. Uh, and we did that. We set up in 2008, we changed the name. So I ended up with ended four corners and started with Litmos wines, which was a UK based company. Um, Sam left in 2010 to go back and to go back to New Zealand. Uh, so I bought his shares and we moved to Debbie’s vineyard in dorking, uh, where they were our first major client. Um, so we can solve for them some that I’m the chief winemaker there. We make all their wines and we do their, um, this external sales.

John Worontschak (25:22):

So to this day, we still do all their, all their own labels for whoever, little Sainsburys, MNS, everybody. Um, and so, uh, and then also change the focus of litmus wines to a contract wine making service like was in terms of Valley. And we’re now doing over 200 tons of contract wines at den bees for various clients. And we rent the equipment at Denby to do that. We also import, um, biotech, uh, for wine industry, uh, worked closely with IOC there. Uh, do disgorging do contract bottling. We do, we, you know, we were pretty much devastated. This is beautiful because again, like when people think of a vineyard, they think, okay, I’ll pay for a sec, I’ll get sample five or six different wines, maybe have a, like a cheeseboard or charcuterie a NASTAR, but there’s more than just us. And then you’ve got the wedding, um, packages, you do corporate events.

John Worontschak (26:16):

What else can people expect? Yeah, obviously I have nothing to do with that side of the business. Um, it’s, it’s owned by the white family, um, and they’ve got a fantastic business and fantastic business model. Um, not only the wine and the wineries, but the I’ve got, uh, two to three restaurants. Uh, they do, as you say, weddings, um, I’ve got a brewery, they lease their, they’ve got a farm shop. Uh, they have something like 300,000 people a year footfall. So it’s a really successful, tight little business. I think there’s about 120 employees. Um, and we’re just a part of that. We, we, we look after the sort of production of the wine, um, and, uh, and as, as, as to this day, so we’re picking, we’re picking this week, we began picking on Monday. Beautiful, beautiful, and an interest in one concept that I’m fully on board with was the gin King, or is the King company started in 2017 and still present?

John Worontschak (27:13):

I, I remember, I think it was in my local Waitrose for that mustard. I remember seeing this Basile King, very beautiful label, very, very unique bottle on Psalms of it being Jenn and King. And you look at the look at it and it’s a blend of gin making sales or Y making skills. And it’s an infusion of both, which absolutely goes well as an aperitif. And then a pass is so on and so forth. What did you see that gap in the market? Well, what for, you was like, I need to create something. Jinking why Jane King. Okay. So, well, firstly, just a little bit about Litmos since then, I’ve got two partners who were equal shareholders of the company at the moment is Mike Florence and Matthew Elzinga who are buddies. Yeah, we were good. We’re good friends. So that works really well. Um, one day I came home from work litmus and my wife Ruth was saying that she’d know whether she wanted a glass of English, sparkling wine or a glass of gin.

John Worontschak (28:12):

Uh, what would it be like if he put two and two together? And so I rushed over to the off license that we’d have an agenda, bought some gin and put it in sparkling wine, tastes like shit. And so next year sort of like playing with concoctions and trying to work out how to do this. But the interesting thing was I sort of Googled it and no one had ever done it before. And there’s one or two cocktails with gin and sparkling wine, but no one had done an RTD with generous sparkly one. So it was absolutely unique. So I went into the Litmos office and spoke to my buddies. And um, so what do you think about, we, we explore this and, you know, at the time gins booming, sparkling wines, booming and Laura alcohols. So we thought, yeah. And they both said, yes, let’s do it.

John Worontschak (28:49):

Yeah, let’s go. And so, um, cause it makes more sense taxation wise in the room if we ever sell it. Uh, I set up the drinking company, which were also equal shareholders of, um, and, uh, worked out this recipe by which you can infuse gin heavily infused in, um, uh, with botanicals that you want. Um, and what you end up getting with is something which is really quite refreshing. Um, cause you know, wine, you know, a loved one drink too much of it or the, um, you know, sometimes it’s not that refreshing or not refreshing enough gin and tonic, nothing wrong with that. You know, it tastes like tonic water after a while. It’s a bit simple. That’s true. Um, whereas this it’s down to eight and a half percent alcohol, so you can, you can, you can swing it. Um, and it’s got the sort of complexity of wine and the interest of the, of the botanicals.

John Worontschak (29:40):

And so it kind of works. Um, it’s done very well so far. Um, M and S you would have tried it, not Waitrose. Um, but we’re in, um, uh Morrison’s and Tesco’s, uh, and just recently little for a short period of time, um, we’ve sold to slowly grow in the Netherlands. Um, w w we’re talking to Australia, uh, we sold in Singapore called storage. So it’s out there, the problem, not the problem, but the, the thing that had to be overcome was the fact that the originals are made from English wine, which is very expensive and also a bit like rocking horse shit. And there’s not a lot of it around. Um, and so, uh, we had to decide where we’re going to go. If we’re going to make this a large brand, we have to use European one. So, uh, came up the concept of Mediterranean and using Spanish wine with pine needles and having that sort of fresh, it’s not rich scenery, but it’s got a hint of Rosemary and pine and all that sort of stuff in it.

John Worontschak (30:32):

And that’s quite good. And then, uh, the fourth variant we came up with was Botanica Italia, which has got the Muth type a botanicals in, has got Angostura bark and Genti and rutin. And what have you. So that’s a bit bitter. So there’s four different things in the story is like Lord Warren cheque traveling around the world and sabbatical goes to Italy and does, does does this thing. So this sort of marketing, um, marketing, uh, hype going around it as well. So hopefully one day somebody will come along and say, mr. Orange, Hey, we want to buy your company. And then you hear about it a lot with these, um, these gin companies, which have been popping out and especially the last year and a bit. So you got, you got in before most people got in. And so on that logic, that logic thing is crossed fingers crossed.

John Worontschak (31:18):

We want to do it just yet because it’s so much fun, but I’m getting old well older or better, maybe a bit wiser, but, um, okay. Present situation. Um, COVID self C four for the economy has taken a bit of a battering and there have been job losses and whatnot, you know, we’re, we have found, uh, Colson, boutique and fats, um, because people do consume wine business has been actually very healthy as opposed to business going the other way. But, um, you know, for yourself and for the businesses you represent, how have you been doing, um, well, the warrant check one services, which is basically, um, international consultancy, obviously. Um, that’s gone down a bit, but it’s also made me reconsider, you know, the whole concept of, of AMI miles and the planet and sort of, is it really good to be a gold member of British airways for 15 years?

John Worontschak (32:15):

And, you know, just traveling around so much and you can do a lot less of that and doing a lot more zoom tasting and things. So that’s, it’s, it’s still going, but that, that, that’s, that’s down big time, um, in terms of, uh, the litmus wine range, which we haven’t talked about yet, the English ones, uh, they’re doing very well in, in, in, in, um, in terms of online, online sales. Uh, but obviously the restaurants we’re in the [inaudible] sort of places in London that’s gone down, but sales of litmus wines are keeping up. King is going well, but every penny we make, we reinvest into social media and marketing and that’s to try to, to try to get it there. So that’s not me. That’s never made any money. Um, and the contract winemaking or good, um, no change. So we’re keeping our head above water and we’re managed to managing to pay ourselves what we always have.

Cult & Boutique Wine Management (33:11):

Okay. Okay. So with regards to litmus wines, I’ve been up to try, um, a number of them, very, very delicious. And of course, when people do think of English wine, it will be litmus. It will be the likes of Knights Himba chapel down, et cetera. Are you satisfied with, you know, being in that group of very respected names or are you striving to be the number one? So when people think English wine or even European wide, and the thing can, let’s miss elements Wednesday, but forget friends peeing on the wall. We want to litmus pin and what yeah.

John Worontschak (33:49):

Yeah. Um, I think the journey of learning my journey of learning about wine is really reflected in Litmos wines and from the things I was doing back at Tim’s Valley vineyard. I mean, those wines were simple and a lot of English wines still are, you can get very fragrant, fresh Bacchus is very nice, a bit one dimensional, but there, and that’s the kind of thing you do with that standard wine making built from 2010, when the first element 20 litmus wine was produced, I’ve been trying to up the game at the antique to make them more food wines make the more Northern European, the more complex and an incredible aging potential cause with the kind of PHS and acidities we can get in the UK. If you’ve got good grapes to start with, you can eat the 2010, for instance is 10 years old, English white wine is delicious. Now it’s probably better than it ever has been.

Cult & Boutique Wine Management (34:41):

So, uh,

John Worontschak (34:45):

It’s the change in my wine making style and thinking has gone a lot. These wines are a a hundred percent barrel aged. There’s four there’s four in the range. Now the element 20, which is the first one, that’s generally a combination of Chardonnay and backers, a hundred percent modal, lactic barrel, Baton arched, and very, very low sulfur regimes, minimal intervention, white peanut and wire, which I decided to do that in 2011, because I had was one from Trentino. It was delicious. And that seems to work every year, just hold very pressed. And it’s one, but because of it’s from a red grape, you get huge sort of mouthfeel from it, the red pin and wire, which only doing years when, when, when it’s capable, when you can find a vineyard, which has got some God very ripe fruit, and then more recently the orange, which is annoyingly doing very well, because really matter, it’s just a backers on skins.

John Worontschak (35:38):

Um, and that’s, and that’s, and that’s doing well. But to go to answer your question, the whole concept of element 20 was to, uh, if you say Lebanon, people go Chateau Musar. And so, uh, I want said to that and still want that to be a, if you think you’ve English still one, forget the sparkling. So you’ve got, you’ve got your night timbers, whatever we want English still wines. It would be nice if any, if people just thought element 20 and that’s what we’re trying to go. So yes, we’re trying to be number one, uh, and, and trying to do it well. Um, and hopefully the results over the years have shown that we’re consistent and we’re making good wines. Um, they do sell, they settle for restaurants, but they’re very small 10,000 bottles a year. I mean the whole range. So it’s, it’s, it’s a tiny bit of the business, but it’s an important part of the business in the fact that, um, our contract clients can see what we’re capable of.

John Worontschak (36:30):

Um, and aspire to that. And so, alright. Couple of quick fire questions, and then, um, obviously I’ll let you get on with the rest of what you need to do to carry on, um, vice versa as well. So you’ve had lots of positive Cresco or claim Angie Deford of the cancer magazine. John’s Robinson, Oz, Clarke, all praising yourself in particular on the wines, in which you’re involved with. What, what is it, what is it for yourself being involved for the period of time that you have, where you feel okay, I’m going to rest my hustle that now I’ve done all I’ve needed to do. This is my legacy.

John Worontschak (37:12):

I don’t think that’s going to happen. Okay. Okay. I think I love my job. I love wine. I love work. I’m going to keep on doing it until the day I die. I’m not going to retire that I can see. I can’t imagine what I’d do if I retired or I would like, I would live this wine, I guess is the, is the ultimate cause that’s when you’ve got full control, um, from label design to, to, to the vineyard, um, and you know, small volumes of, of, of very nice wine. And maybe when I’m old, Daughtery, that will be the thing and waste. The millions are made from drinking on, uh, making overly expensive wine that nobody will pay for. Oh, would you plan on retiring within the UK or maybe, uh, would you have asked Australia or a different country? Well, it’s funny when I go back to Australia, now it is a foreign country, so I’ve been here for so long now.

John Worontschak (38:10):

I, and I’ve always felt more European than, than, than, than Australian. Uh, so it would be definitely somewhere in Europe, probably in the Southeast of England in Lymington somewhere. I know somewhere. Nice. So, um, and then, you know, spend, spend, spend out the days there maybe with a tiny vineyard, but just being unwell, I guess, just okay. If you’re going to push me on that, I say a couple of hectares of seven, seven, seven 77 clone peanut Mar make a few barrels and share it amongst friends Sal’s parfaits. And, um, is there any, is there any wine out there that is like your desert Island wine? What, what, let you try it. Okay. Two part question one that you’ve tried that you’d love to be left for two weeks on a desert Island with just so you can drink that every day for two weeks straight, but also a wine that you’ve yet to come across that really is on your bucket list, so to speak.

John Worontschak (39:04):

Okay. So, um, in the year 2000, I was making wine in the market, um, in Italy and went to a restaurant and there was, we had a bottle of 1980, uh, filler Bucci, uh Verdicchio. I was just unbelievably good. I, it was, it was just everything you could possibly from one, it was the closest thing to perfection and it shouldn’t be radicchio, shouldn’t be, um, and so I bought, there was, I think the restaurant had six or seven bottles left. So I bought those, uh, took them home with me, thinking that I’d get there and, you know, it was just the occasion, but it wasn’t, you know, every single one of those bottles, I save it and enjoyed with good friends. And so the next time I was there actually found Villa boujee and went to, went to there and said, if you’ve got any 1990 and they said, well, no, we haven’t, but if you have, we’ll buy them from you.

John Worontschak (39:53):

So, um, that, that that’s the wine that really sticks in my mind. So it wasn’t an expensive one. I think I’ve ended up paying 25 years a bottle or something like that, but it was, it was a remarkable wine. Um, what I haven’t tried, which I would like to would be, you know, verticals of a really good first growth, you know, the things that, the kind of things that Janice would do every Wednesday night, you know, have a really good, I mean, you know, a 45 or 61, or, you know, and I would, I would like to just, just to see, you know, what that’s about. I mean, I’ve had first gross obviously, but 45 60 was not verticals, different class, different class. Alright, lastly, um, what is the, what is the future moving forward for, for yourself litmus wines and obviously the other business ventures you do have, um, litmus wines and drinking, uh, the two most important businesses at the moment, um, litmus wines, uh, is doing very well.

John Worontschak (40:58):

Um, we have a lot of fun. We cook lunch every day. We’ve got a nice kitchen. We, um, you know, work hard and play hard and it was it’s, it’s as enjoyable as it is. I don’t want that to stop. So, uh, Jean King is a different thing because it’s moving away from the concept of trying to maximize quality into getting something, which you have to get your head around to maximizing enjoyment, and then how to convey that enjoyment to the great unwashed public. So Institute to do that. And the, and the business side that, um, I haven’t got the business acumen, uh, to, to make a globe to make a global brand. So I have to import that, um, one of the many benefits about doing what I’ve done from working for DGB in South Africa, working for Penfolds in Australia is seeing the corporate world and being part of it from the outside, realizing I don’t want to be part of that.

John Worontschak (41:57):

Um, but kind of understanding it. Um, and I guess jinking is the first, um, thing, which I’ve been part of creating, which is leading towards that kind of mentality. We have to think in a way, which isn’t, you know, haven’t got enough money in the bank next week. It’s like, sort of show much do we need to spend and to stretch it, to make the strategy to, to, to, to, to get there and to be successful, which is exciting and keeping me awake at night, um, and perhaps a bit younger than I am. All right. Understood. All right. So all excites and moving forward, which is great. So I wound up positive news, John, thank you very much, joining us today. Uh, good luck for our thing for the future. Um, and obviously again, guest since number one within the wine trade and eventually send off Jean King as well, you know, as the next big thing for sure. Butts. Um, and thank you very much joining us to, um, until next time, all the best.

Based in south-east France, the Rhône Valley runs from north to south following the meander of the Rhône river. Spanning around 150 miles in total, the region is home to many different micro climates and soil types and is split into two distinct sub-regions, Northern Rhône and Southern Rhône.

Some of the world’s most highly acclaimed wine critics list the Rhône Valley among their favoured regions

Northern Rhône is best known for producing high quality, small production wines made with Syrah grapes, as well as an impressive selection of white wines predominantly from Roussanne, Marsanne and Viognier grapes. Appellations such as Cote Rotie and Hermitage are synonymous with quality but these sought-after wines only represent a small percentage of the Rhône Valley’s total output.

Geographically larger, the Southern Rhône sub-region makes use of a much wider list of varieties, including the renowned Chateauneuf-du-Pape cuvees. Grenache, Syrah and Mourvedre are also found in abundance allowing for the south’s popular ‘GSM’ blend.

Some of the world’s most highly acclaimed wine critics list the Rhône Valley among their most favoured regions. Robert Parker Jnr paid particular attention to the region for decades stating as far back as 2000 that “No region of France, with the possible exceptions of Languedoc-Roussillon and Burgundy, has made as much qualitative progression as the Rhône Valley.” And it’s this development and refinement that has become one of the biggest factors in the Rhône Valley’s growth in the market. Jeb Dunnuck has also heaped praise on the region, singling out some of the more exclusive Northern Rhône wines as firm favourites over the years.

Rhône Valley is seen as a long-term environment for growth and you should be prepared to hold on to these wines for up to ten years

Recent Performance

The financial performance of Rhône wines has been slow but reliable over the last decade and although there are some exceptions, the region is yet to see a huge boost in values that have been seen across almost all other prestigious wine-producing regions.

As a result, the Rhône Valley is seen as a long-term environment for growth and you should be prepared to hold on to these wines for up to ten years to see the best return on investment. However, if drinking tastes change, as they did with Bordeaux and Burgundy in recent years, holders of the region’s most sought-after wines could do very well indeed.

Recent performance has been quite impressive. Since the beginning of the year, Rhône experienced a surge in trade, by April trade by value had tripled compared to January and by June the region had 60% more buyers and 73% more sellers than it had in January.

Taking at least one good position in Rhône should help to diversify a wine portfolio and protect against potential under-performance from other, more widely traded wines. Always be prepared to play the long game but when a region as loved as the Rhône Valley has so many top-flight wines, you never know when the market will turn and provide a boost to values.

Sought-After Wines

The number of wines produced in Northern and Southern Rhône which are considered investible grows with every great vintage. Whether you drool over minuscule production, single vineyard Syrah, or prefer a solid CNDP, we’ve put together a list of some of our favourite investible wines from the Rhône Valley

E.Guigal Cote Rotie

It would be impossible to write about the Rhône Valley without mentioning Guigal’s trio of Cote Rotie wines – La Mouline, La Landonne and La Turque – affectionately known as the ‘La La’s’.

It would be impossible to write about the Rhône Valley without mentioning Guigal’s trio of Cote Rotie wines – La Mouline, La Landonne and La Turque – affectionately known as the ‘La La’s’.

A particular favourite of Robert Parker, these Northern Rhône wines have a record of providing impressive growth but be prepared to hold them for ten years plus to see a great return.

Chateau de Beaucastel ‘Hommage à Jacques Perrin’

Beaucastel is a Southern Rhône stalwart whose history can be traced back as far as 1549 when Pierre de Beaucastel purchased the original plot of land. Ownership changed hands several times through the years and is today owned by the Perrin Family.

Beaucastel is a Southern Rhône stalwart whose history can be traced back as far as 1549 when Pierre de Beaucastel purchased the original plot of land. Ownership changed hands several times through the years and is today owned by the Perrin Family.

The jewel in Beaucastel’s crown is the ‘Hommage a Jacques Perrin’ which has been produced since the 1989 vintage as a tribute to their father and has become an established collector’s wine. Only produced in exceptional vintages, in tiny quantities (around 400 dozen per vintage) a good example can happily sit in bottle for forty years plus. This wine demands a longer growth cycle and the best results are often achieved for aged vintages sold at auction.

Chateau de Beaucastel ‘Chateauneuf-du-Pape’

A more affordable option is Beaucastel’s Chateauneuf-du-Pape. This great value CNDP blend can be sourced on release for around £550 for a twelve bottle case.

A more affordable option is Beaucastel’s Chateauneuf-du-Pape. This great value CNDP blend can be sourced on release for around £550 for a twelve bottle case.

Due to the relatively low buy-in price, you would need to acquire several cases to produce a satisfactory return but this label remains easily tradable on the market. The 2016 vintage which Wine Advocate scored 97/100 has grown in value by more than 31% over the last two years.*

J L Chave Cuvee Cathelin

J L Chave is another big player in the Rhône Valley and the Cuvee Cathelin is seen as the pinnacle of their output. The Cuvee Cathelin has been one of our best performing wines from the region, although hen’s teeth and rocking horses spring to mind for the more sought after vintages.

J L Chave is another big player in the Rhône Valley and the Cuvee Cathelin is seen as the pinnacle of their output. The Cuvee Cathelin has been one of our best performing wines from the region, although hen’s teeth and rocking horses spring to mind for the more sought after vintages.

UK prices for aged examples have risen above £8,000 a bottle but allocations of new vintages are sparse – get in early if you can but there are also opportunities in the wider growth cycle to generate impressive returns as the wine matures and remaining stocks dwindle.

Henri Bonneau Reserve des Celestins

Henri Bonneau was one of the most revered winemakers to work the Rhône Valley and his Chateauneuf-du-Pape blends have become legendary through the decades. The Bonneau vineyard and winery are steeped in history with evidence of vines being planted as far back as 1667. Henri sadly passed away in 2016 and winemaking duties are now handled by his son Marcel.

Henri Bonneau was one of the most revered winemakers to work the Rhône Valley and his Chateauneuf-du-Pape blends have become legendary through the decades. The Bonneau vineyard and winery are steeped in history with evidence of vines being planted as far back as 1667. Henri sadly passed away in 2016 and winemaking duties are now handled by his son Marcel.

The Reserve des Celestins made its debut in 1927 and has become their most famous and expensive wine. Made from a blend of Grenache, with doses of Mourvedre, Syrah and other local varieties. The wine is only produced in exceptional vintages using only the best barrels, ensuring that every vintage produced is unique. A great example of this wine’s potential is the 2010 vintage which has grown in value by 114% over the last five years.*

Domaine du Pegau Cuvee da Capo

Another Southern Rhône name that can be traced back to the 17th century is Domaine du Pegau. Their Grenache dominated blend ‘Cuvee da Capo’ has grown to become one of the most sought-after wines from the Rhône Valley. The average production of this wine sits at around 500 cases per vintage and as with many special Rhône wines, it is only produced in exceptional years.

Another Southern Rhône name that can be traced back to the 17th century is Domaine du Pegau. Their Grenache dominated blend ‘Cuvee da Capo’ has grown to become one of the most sought-after wines from the Rhône Valley. The average production of this wine sits at around 500 cases per vintage and as with many special Rhône wines, it is only produced in exceptional years.

Quality control is of the utmost importance and since the debut vintage in 1998 there have only been seven vintages produced. The best return can be found over the long term and similar to Beaucastel’s ‘Hommage a Jacques Perrin’ best results are usually found at auction for well-aged vintages.

Getting Started

Most of the wines mentioned above are extremely hard to source which is one of the main driving factors in their financial growth. If you are thinking about taking a position with this type of wine you should develop a relationship with a trusted merchant who will have connections with suppliers and can do the leg-work for you.

The value of these wines does tend to jump rapidly and then plateau for a while, so ideally a merchant who is prepared to watch the market on your behalf and notify of beneficial buying and selling opportunities. With the right guidance and some patience, the Rhône Valley’s premium wines have the potential to outperform the majority of traditional investments in your portfolio. Happy hunting!

By Spencer Leat

*Liv-ex, September 2020

The ‘en primeur’ system for selling classified Bordeaux pre-release is well established and has been at the forefront of the fine wine market for many years, but in recent years enthusiasm for this market mechanism has waned. Could this year’s campaign turn things around?

The idea is simple, the chateaux provide barrel samples to leading critics and based upon their comments, along with vintage reports and other influential factors, buyers then decide whether or not to purchase an allocation ahead of release, with the general idea being that this would represent the base price which should rise over the following years.

However, in the last decade many have felt that the release prices of top flight Bordeaux have been blinkered to wider market sentiment and have increased regardless of the market’s appetite to purchase them. This led to a number of underwhelming campaigns with Chateau Latour famously withdrawing from offering en primeur entirely.

However, in the last decade many have felt that the release prices of top flight Bordeaux have been blinkered to wider market sentiment and have increased regardless of the market’s appetite to purchase them. This led to a number of underwhelming campaigns with Chateau Latour famously withdrawing from offering en primeur entirely.

This year the long-standing tradition of en primeur was disrupted by the arrival of Covid-19. And although at one point there was talk of this year’s campaign being cancelled completely, it eventually went ahead, albeit slightly delayed.

The critics have been very positive about this vintage with most of the leading chateau receiving barrel scores ranging upwards of 96/100. Weather-wise, 2019 has been described as a ‘miracle vintage’ because it managed to avoid the damaging affects of hail storms and the threat of mildew or rot. But these two positive factors are butted up against some of the most exceptionally challenging trading conditions that the market has ever seen.

Trading became so frantic that at one point Liv-ex’s trading platform actually crashed temporarily

When the chateaux started to publish their 2019 release prices we were pleasantly surprised to see wines being offered at prices between 20% to 30% lower than the 2018 vintage. In many cases the volume of wine being offered was also down by roughly 20%, which is good news in a supply and demand environment.

This has injected a well needed dose of positivity into the market and the reaction was immediate. Mouton Rothschild in particular saw a flurry of trading as the world’s leading critics awarded very positive scores and praised the 2019 vintage. Trading became so frantic that at one point Liv-ex’s trading platform actually crashed temporarily whilst buyers tried to secure their allocations.

This has injected a well needed dose of positivity into the market and the reaction was immediate. Mouton Rothschild in particular saw a flurry of trading as the world’s leading critics awarded very positive scores and praised the 2019 vintage. Trading became so frantic that at one point Liv-ex’s trading platform actually crashed temporarily whilst buyers tried to secure their allocations.

It is still early days but given the volatility and bleak outlook that some traditional investments are currently offering, we feel very confident that this could be the kick that Bordeaux needs to reclaim some of it’s market presence that has been eroded over the last coupe of years.

Long standing clients may remember that Cult & Boutique withdrew from offering En Primeur to clients after the 2008 vintage, as we felt release prices no longer represented good potential for growth. However, in light of this year’s price adjustments we are offering the 2019 Bordeaux vintage as an En Primeur purchase.

So, if you would like to resume your involvement in wine futures, or indeed if this would be your first time, please feel free to contact us to learn more about the process and see what opportunities are available.

By Spencer Leat

The wine market has been challenged like any other following the widespread disruption caused by Covid-19 but depending on your outlook there remains plenty to be optimistic about.

When trade started to slow down the obvious knee-jerk reaction for sellers was to lower their asking prices to stimulate trade. This has softened prices across the board and we have watched Bordeaux’s share of trade slip to record lows in recent weeks.

The chart above shows how sellers have reduced their asking prices in order to stimulate sales. There is a defined increase in the level of discount relative to market price since lockdown took effect in March. Justin Gibb, co-founder of Liv-ex was quoted last month stating “It was a market struggling to go anywhere and feeling a bit tense” but went on to add “Now we’re in April and the market’s reasonably steady.”

While it may be true that trying to offload premium Bordeaux at a good price is tricky at present, wine is a long term market that will no doubt bounce back. The other side of that coin is the opportunity that lower prices can offer to buyers, those with a long term view and confidence in the market could take advantage of current prices to strengthen their portfolio.

Those able to weather the storm may choose to hold or even capitalize on buying opportunities. But for most, keeping turnover ticking over will require lower prices and the opportunity to reinvest in stock at the new level.

Liv-ex

The wine market is constantly evolving and many regions that offer a similar quality of wine to premium Bordeaux but at a lower price point have been thriving. Regions such as Napa Valley, Tuscany, Piedmont and Rhone have benefited from this and will now be familiar to most of active wine investors. We are beginning to see the price gap between these regions and Bordeaux narrow, as buyers and sellers acknowledge the opportunities that can be found elsewhere.

This was confirmed at the end of the first quarter when Liv-ex released details of best price performers. Half of the wines on the list were Italian, three were from Rhone and one each from Burgundy and Spain. Bordeaux did not make the top ten list but remains and integral part of the market with the largest share of trade, albeit at record lows for the region.

Italian wines in particular have continued to take big strides after securing the top spot in Q1. Recently Italian wines hit another record high in trade by value, securing 27.7% of trade, up from 19.5% the previous week. Californian wines have also held steady on the secondary market, particularly at auction where top flight Napa, including Screaming Eagle and Harlan Estate, has remained in demand commanding respectable prices.

The market for Bordeaux remains solid, accounting for 24% of both the dollar amount and bottle count sold. Champagne, California, Rhone and Italy combined for 18% of revenue and the bulk of the rest of sales.

Acker, Wine Auction House

Although regular updates on the price movements of fine wine and the market are essential to keep in touch with the here and now, it’s important keep hold of the fact that fine wine has traditionally rewarded patience. Five years should be the minimum outlook to see satisfactory returns, and over this time span it’s hard to find examples of the market under-performing.

In a similar fashion to traditional financial markets, the type of trading conditions we are currently experiencing should be of interest to long term buyers, and the fact that the Liv-ex 100 has returned 205% over the past fifteen years should also offer some reassurance of the wine market’s ability to weather the storm.

By Enzo Giannotta

Will Covid-19 simply accelerate the inevitable?

Our previous article looked at the wine investment market’s initial reaction to the Covid-19 outbreak, and there was plenty to be optimistic about. With many wine merchants reporting a sharp uptick in sales since the Coronavirus lockdown, has this demand been echoed in the fine wine investment market?

Two weeks ago we were beginning to come to terms with being locked down, the equities markets had been in turmoil and workers across the UK were getting used to working remotely, or not at all in some cases. Despite this the wine market had shown signs of stability with the Liv-ex 50 only showing a fraction of the losses seen in equities and some regions continuing to increase their share of trade, of course at Bordeaux and Burgundy’s expense.

By the end of March Bordeaux’s share of trade had slipped to a record low and with Burgundy also losing ground, the ongoing power shift continued leaning toward other regions. The USA made great strides and helped to double the Rest of the World’s share of trade from 5% last year to 10% in 2020, hitting a new record high.

Last Friday Liv-ex reported that their benchmark index, the Liv-ex 100, had declined by 1.06% during March, but against a backdrop of global financial turmoil this could almost be seen as a victory. The broader Liv-ex 1000 index also fell last month, shedding 1.35% despite Italy trying its hardest to prop performance up. The index has struggled since Trump introduced tougher import tariffs in October 2019.

this may well represent a good opportunity to strengthen your position before things starts to advance again.

The Italy 100 index has grown by almost 4% over the last twelve months and continues to be an area of focus for drinkers and investors alike. Recent releases from Tuscany and Piedmont have proved popular with merchants and have helped to boost results. Following a great start to the year Champagne remains in our buy zone. Prices started to stagnate by the beginning of April due to a build up of stock on the market but based on the region’s performance to date, this may well represent a good opportunity to strengthen your position before things starts to advance again.

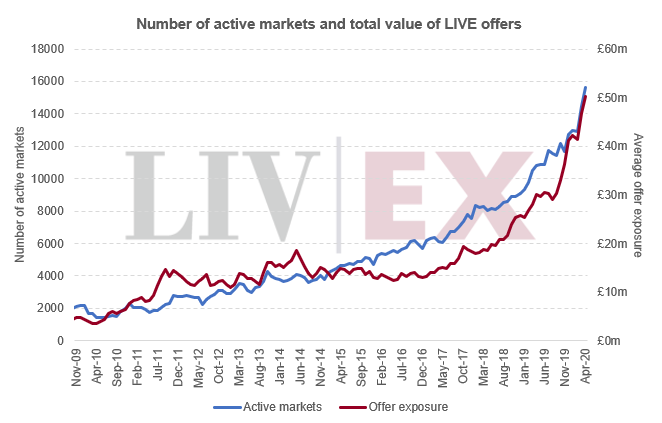

It’s definitely not all doom and gloom, during the first week of April the value of fine wine available on the Liv-ex exchange exceeded £50million for the first time in its history. This is a reflection of the wine trade adapting to overcome the closing of bars and restaurants, and following an initial drop in bidding activity there is evidence of buyers returning to the market now prices have softened.

It’s definitely not all doom and gloom, during the first week of April the value of fine wine available on the Liv-ex exchange exceeded £50million for the first time in its history. This is a reflection of the wine trade adapting to overcome the closing of bars and restaurants, and following an initial drop in bidding activity there is evidence of buyers returning to the market now prices have softened.

China is ready for business and wants the world’s greatest wines as much as ever

Acker Chairman, John Kapon

The auction scene has been much more positive. Acker’s first Hong Kong online sale since the virus took hold saw strong demand with Domaine de la Romanee-Conti (DRC) and Japanese whiskies rising to the top. Driven by Chinese buyers, the sale saw a magnum of DRC Romanee-Conti set a new world record selling for USD$57,231. Acker Chairman, John Kapon commented “it was very reassuring to see strong demand across the board in this intimate sale. The three top buyers of the sale were from three different cities in mainland China, which shows that China is ready for business and wants the world’s greatest wines as much as ever.”

The auction scene has been much more positive. Acker’s first Hong Kong online sale since the virus took hold saw strong demand with Domaine de la Romanee-Conti (DRC) and Japanese whiskies rising to the top. Driven by Chinese buyers, the sale saw a magnum of DRC Romanee-Conti set a new world record selling for USD$57,231. Acker Chairman, John Kapon commented “it was very reassuring to see strong demand across the board in this intimate sale. The three top buyers of the sale were from three different cities in mainland China, which shows that China is ready for business and wants the world’s greatest wines as much as ever.”

Meanwhile their latest online sale in New York took place on 3rd and 4th April. Attracting buyers from around the world, it delivered some very good results with a total of 119 new world records set. The top ten was again dominated by Burgundy. A jeroboam of 1990 Dujac Clos de la Roche came out on top setting a new world record at USD$43,400, followed by great results for Petrus, Leroy, Meo-Camuzet and Rousseau. Following the sale Kapon acknowledged the global challenges we face adding “it is wonderful to see that demand for fine and rare wine remains healthy, and that people remain engaged. Wine remains something that will always bring people together even if physically apart”

Seeing this overall level of consistency within the fine wine auction market is encouraging

Cult & Boutique Managing Director, Enzo Giannotta

The fine wine market revolves around supply and demand, so it’s great to see the consumption end of the market thriving. We feel that Bordeaux’s reduced trade share can only benefit the market as a whole. As the back bone of the market it should always take the lion’s share, and will no doubt remain as the blue chip element. The ground it has lost will allow Italy, USA, Champagne and Rhone to flourish as the market further diversifies, and ideally the spread between prices should also continue to contract.

Cult & Boutique’s Managing Director, Enzo Giannotta added “seeing this overall level of consistency within the fine wine auction market is encouraging. Even though results vary for individual products due to the pure volume of lots sold over two days, it offers a viable exit strategy and a very rewarding one for those with the most patience.”

By Spencer Leat

With the first quarter of 2020 behind us, we take a closer look at our Q1 best seller and its price performance within the market.

Sparkling wines from the Champagne region of France have been steadily gathering momentum for a number of years. This progress was highlighted at the end of 2019 when Liv-ex announced that three Champagnes had made the top ten performers of the year. One of those three wines, Salon’s Le Mesnil 2002, has remained popular with our customers to become our best seller of the quarter.

Just 37 vintages were produced in the 20th century, a unique phenomenon in the world of wine

Salon

Salon Le Mesnil is a sparkling white wine made from 100% Chardonnay grown in the Le Mesnil-sur-Oger vineyards. The first commercial vintage was produced in 1921 but a vintage is only declared when the quality is deemed to meet strict standards. This results in an average of around three vintages being released per decade, production is small at approximately 60,000 bottles per vintage which also helps add to the excitement each time a new release enters the market.

Salon has been held in high regard since its arrival, in the Roaring Twenties it was the house champagne at Maxim’s and has been enjoyed by high society ever since. Today Salon is globally recognised as one of the top Blanc de Blancs and although the house has changed hands several times since Eugene-Aime Salon’s passing in 1943, the quality has remained intact solidifying its place as one of the most desirable and expensive Champagnes on the market.

Released into the market in 2014, the 2002 joined a succession of well received vintages with critical acclaim. Antonio Galloni described it as “utterly mesmerizing”, Julia Harding MW found “definition, clarity and finesse” while The Wine Advocate’s William Kelley recently proclaimed the release “full-bodied, broad and powerful”.

Salon 2002 is a great romantic, but also armed for battle! Its strength and audacity give it the balance of a classical dancer

Salon

Market data from Liv-ex shows that price performance has also been good, over the last twelve months the market value of the 2002 has grown by 12.5%. Spanning back over two years the growth figure more than doubles to 30%, and taking a five year view of past performance unveils an impressive 108% gain.

The highly anticipated 2008 vintage was released late last year, but with a twist. The latest vintage was to be released in magnum format only and limited to just 8,000 bottles in total. Sold as the ‘2008 Salon Limited Edition Oenotheque Case’, the handcrafted collector’s case contains one magnum of the 2008 and two regular bottles of the 2004, 2006 and 2007 vintages.

It is quite simply one of the most magnificent Champagnes I have ever tasted.

Antonio Galloni

It’s yet to be seen how prices will react to the huge disruption to global business and financial markets that we are seeing but signs are looking good so far. The wine market has been in a state of flux for some time now with Champagne emerging as a beacon of success, alongside Italian and Californian wines. If history has taught us anything about the wine market it’s that wine usually thrives when traditional markets struggle. Additionally, once this mess stabilises there will no doubt be swathes of celebrations around the world which will require lubrication – and which drink do we choose to celebrate?

By Spencer Leat

Wine has a proven track record of stability during some of harshest financial storms

This is a concerning time for everyone but investors have had a very bumpy ride via the global equities markets and its knock-on effects. Following Boris Johnson’s escalation of social distancing and isolation measures, many are wondering where to look for stability among all the uncertainty.

Wine has a proven track record of stability during some of harshest financial storms we have weathered to date, but how has the wine market reacted to the Coronavirus outbreak?

With a low correlation to equity markets, fine wine moves at a glacial pace and is generally influenced by two long term economic fundamentals – namely supply and demand.

Liv-ex, March 2020

The modern fine wine market has come a long way since the days of deals being brokered over the telephone from faxed stock lists. The introduction of online auctions, exchanges and logistics have helped to build an environment where trade can be conducted remotely. Wine can easily be bought, sold, viewed, valued and delivered online with the help of trade partners in the supply and logistics chains.

The Liv-ex Exchange remains open for trade reporting today that their Fine Wine 50 index (which tracks the price movements of the last ten bottled vintages of the Bordeaux First Growth wines) had retreated just 3.45% year-to-date, holding relatively firm in comparison to the free fall witnessed on the FTSE 100 & 250 and around the world due to panic selling.

Zachy’s auction house in the US also confirmed to us today that they are open for business, giving access to another key sector of the wine market. Following from last year’s successes which saw them become the most active fine wine auctioneer generating $121 million worth of sales, Zachy’s form part of a global fine wine auction market which grew by 9% in 2019 from $479 million to $521 million.

We’ll continue to monitor the market as the situation develops and if you’re yet to take a serious look at the market yourself, now may prove to be a good time to keep tabs.

By Spencer Leat

One of the main draws for many over the years has been the low correlation to equity markets.

The spread of Covid-19 is gripping the World, Europe has now become the epicentre, markets have been reeling, casualties are building up. Although the priority will always be one’s health and the health of our loved ones, the financial implications of this pandemic are very real.

We have been introducing clients into the fine wine investment market for well over a decade and one of the main draws for many over the years has been the low correlation to equity markets. The chart below is a great example of just how fine wine can offer stability to any investment portfolio; it’s also why we are seeing a large amount of interest as investors look for a safe haven.

The main reason for this low correlation is the supply and demand nature of fine wine. Even before the effects of Covid-19 started to hit the financial markets wine had been ambling due to tariffs imposed by the Trump administration. Yet no signs of panic selling have been evident and that trend has continued as we’ve moved into uncharted territory. In fact, it’s been quite the opposite with seasoned investors looking to strengthen their positions.

It’s widely acknowledged that diversification is vital in any investment portfolio

Our ‘4 portfolio’ assemblage takes into account buyers’ tastes, appetite to risk, desired hold terms and budget levels, allowing new speculators to enter the market with confidence knowing the products have been selected around specific requirements. This offer was put on hold last week due to a spike in interest from our existing client base, so it’s my pleasure to announce that we are now asking for anyone who has an interest to submit details via our website here.

These are unprecedented times, yet if we look back at the historical performance of fine wine, when markets are in free fall the results have been strong. In 2011 with the backing of the Chinese government the most successful wine fund in history was launched. Aiming to yield 15% over five years, The Dinghong fund raised closer to 125% across the 5-year period. It’s widely acknowledged that diversification is vital in any investment portfolio and we see fine wine playing an important role for many in the years ahead.

By Enzo Giannotta

On this episode, we catch up with our in-house correspondent Jonathan Whittley to learn more about his background and hear about his wine travels to France, Spain and beyond.

Cult & Boutique Wine Management Limited

Cult & Boutique Wine Management Limited Cult & Boutique Wine Management

Cult & Boutique Wine Management